Image source: https://i.ytimg.com/vi/9tbZoRe-RVQ/maxresdefault.jpg

The updated Internet is packed with tempting provides about effortless earnings within of forex - it will be sweet in basic phrases to guess correctly the trail of the market motion and mushy existence is all set. However, suggestions is additionally neatly said, which signifies that more than eighty% of Forex investors lose their repayments. This is subsequently of the indeniable reality that, contrary to advertising promises, economic markets are near to now not apparently to are looking forward to. But now not each little thing is so sad, there are buying and selling options that don't look to be in accordance to predicting the trail of destiny market movements, nonetheless on other principles. An instance of such options are currency buying and selling arbitrage options in accordance to the extraction of merit from the fee change for the same economic contraptions sold on solely multiple exchanges. As a last effect, these options can consultant you earn in any market motion and don't require the dealer ungrateful work on guessing the trail of the movements of commercial contraptions.

The perspective described is is named the classical two-legged arbitration. But in many solely multiple cases, extensively speaking currency buying and selling, it will be bigger to exploit one-legged arbitrage, within of which transactions are performed only on the aspect of one dealer, that's "led" in relation to the second dealer. In these cases at the same time the quotes of one in the whole crucial brokers are late relative to the second, the merit from the arbitrage provides will assemble on the aspect of the lagging one, so there isn't a component in beginning the contrary transactions on the second dealer.

Consider what opportunities exist for implementing arbitrage options on Forex. First, the first famous sort is arbitrage of update prices. In this case, in general only 1-legged arbitration is used, in view that the at the same time the quotes of one dealer is late relative to an choice significantly is in no way surely very infrequent in currency buying and selling buying and selling. Secondly, a sizable diversity of opportunities is all set as a result of this fashion of arbitration between CFD-contracts traded in Forex and stock update contraptions. In definite, which you are going to probably be able to use quotes from the stock update as a prime precious resource and market only CFD-contracts. Thirdly, it will be practicable to examine arbitration between futures, to demonstrate, from the CME futures market, and CFD-contracts for the underlying assets underlying these futures traded in Forex.

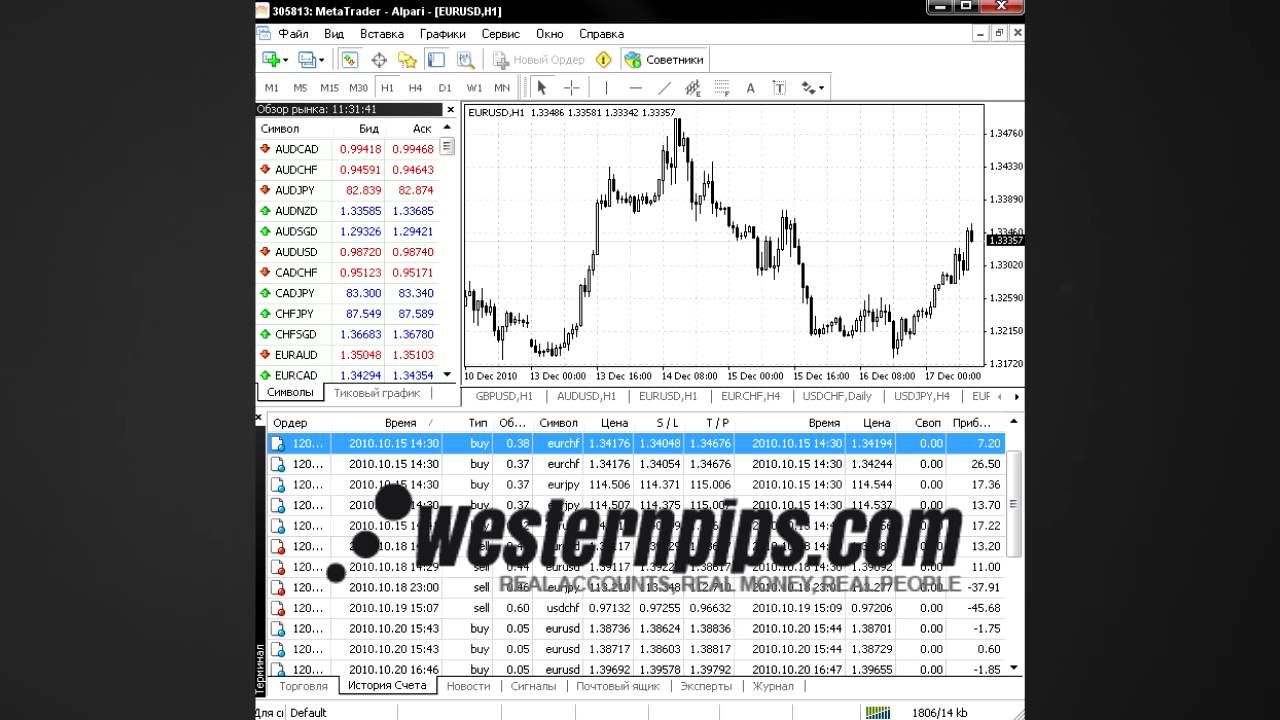

In conclusion, we be aware that updated buying and selling is characterized as a result of the absolute best point of contention among bidders. The dealer who has now not in basic phrases the hottest buying and selling perspective, nonetheless the hottest utility wins. Arbitrage market is a immoderate-tech way of incomes, which demands an as neatly as application - a buying and selling robot able to acting simultaneous operations on many solely multiple buying and selling flooring. As an instance of such a robot can lead Megatrader, which matches with currency buying and selling anyway with the stock market and have have been given to implement near to any arbitrage perspective.